Content

The rest of the coupon payment is used to amortize the bond’s premium. The bond premium or discount is amortized over the life how to find bond interest expense of the bond by what is known as the interest method. This results in a constant rate of interest over the life of the bond.

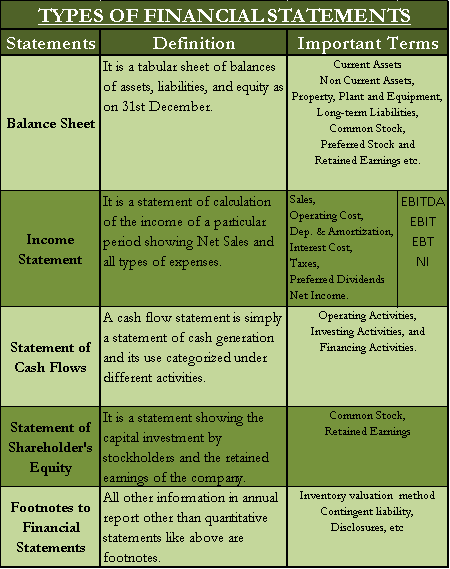

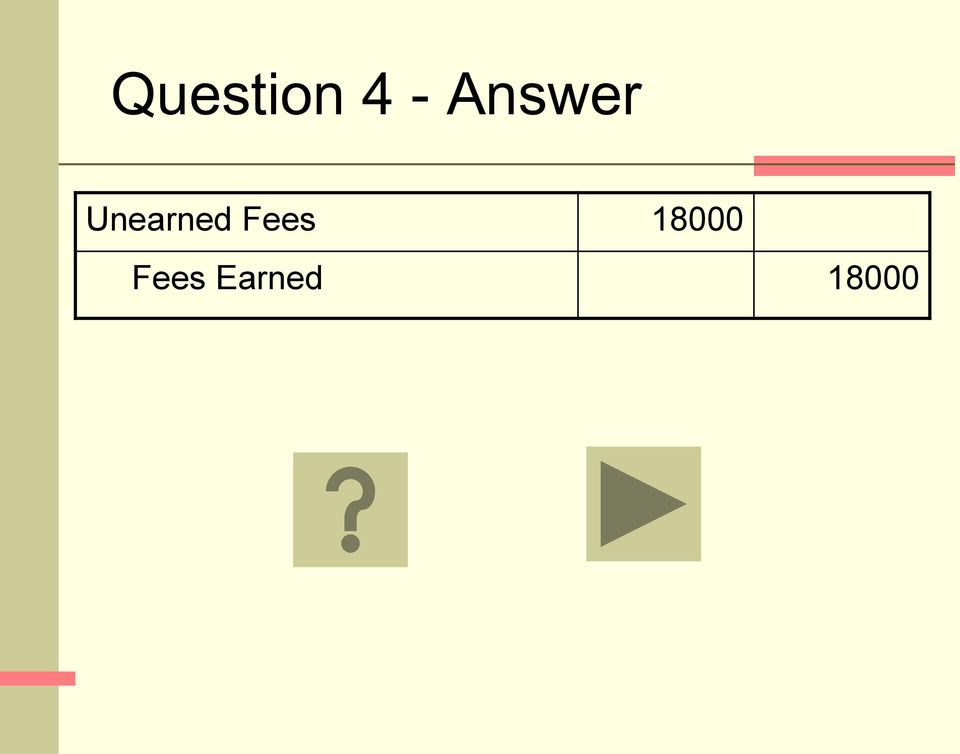

The journal entry would show $100 as a debit under interest expense and $100 credit to cash, showing that cash was paid out. Another account would then be debited to reflect the payment. Prepaid interest is recorded as a current asset while interest that hasn’t been paid yet is a current liability. Both these line items can be found on the balance sheet, which can be generated from your accounting software.

Understanding Bond Payments

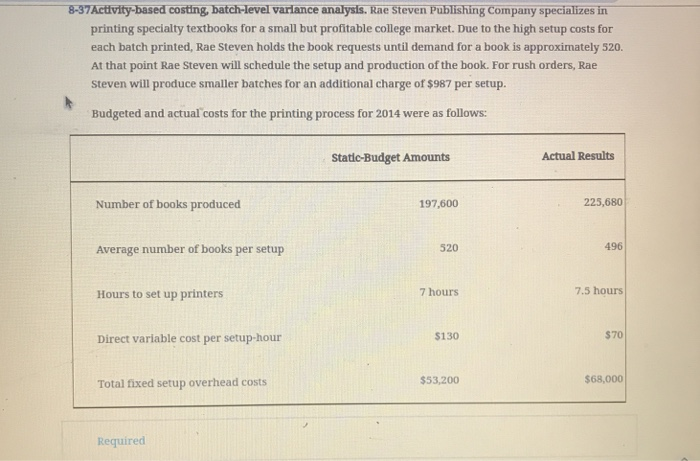

Conversely, if interest has been paid in advance, it would appear in the “current assets” section as a prepaid item. The interest payments made to the bondholders are calculated using the coupon rate and the bond’s face value. For example, for a bond with a face value of $1,000 paying a 5% coupon rate, the coupon per year will be $50. The effective interest rate is multiplied times the bond’s book value at the start of the accounting period to arrive at each period’s interest expense. Market and contract rates of interest are likely to differ. Issuers must set the contract rate before the bonds are actually sold to allow time for such activities as printing the bonds.

This is because the discount (Face value – Carrying value) is amortized over the life of the bond. This is because the premium collected (Carrying value – Face value) is amortized over the life of the bond. With the former, the company will incur an expense related to the cost of borrowing. Understanding a company’s interest expense helps to understand its capital structure and financial performance. Nominal Interest RateNominal Interest rate refers to the interest rate without the adjustment of inflation.

How to Figure Out Total Bond Interest Expense

Balance Sheet (B/S) → The balance sheet is impacted by interest expense because of net income, which flows into the retained earnings line items on the balance sheet. Further, the interest incurred is determined by the outstanding principal on each debt instrument. Every six months, XYZ Corp. will naturally have to pay its bondholders cash coupons of $5,000. However, it isn’t the only amount recorded as interest expense on a bond sold at a discount. Here’s how to calculate interest expense on payable bonds sold at a premium, a discount, or at face value with helpful examples. Due to higher Borrowings, some companies might find hard to see profitability due to higher expenses and there is the sinking of margins with profitability.

Also suppose there is no amortization on this bond and the company pays tax at a rate of 25 percent. Today, the company receives cash of $91,800.00, and it agrees to pay $100,000.00 in the future for 100 bonds with a $1,000 face value. The difference in the amount received and the amount owed is called the discount. Since they promised to pay 5% while similar bonds earn 7%, the company, accepted less cash up front.

Modeling Interest Expense: Circularities from Average Debt

This figure will be available in the documentation for your loan. Establish the outstanding amount on the debt that was originally borrowed during the specified measurement period. The title is transferred to the lessee, the lessee can purchase the asset for $1 at the end of the lease, and the lease term is five years.